Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Why Is Housing Inventory So Low?

One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy? And while it may be tempting to wait it out until you have more options, that’s probably not the best strategy. Here’s why.

There aren’t enough homes available for sale, but that shortage isn’t just a today problem. It’s been a challenge for years. Let’s take a look at some of the long-term and short-term factors that have contributed to this limited supply.

Underbuilding Is a Long-Standing Problem

One of the big reasons inventory is low is because builders haven’t been building enough homes in recent years. The graph below shows new construction for single-family homes over the past five decades, including the long-term average for housing units completed:

For 14 straight years, builders didn’t construct enough homes to meet the historical average (shown in red). That underbuilding created a significant inventory deficit. And while new home construction is back on track and meeting the historical average right now, the long-term inventory problem isn’t going to be solved overnight.

Today’s Mortgage Rates Create a Lock-In Effect

There are also a few factors at play in today’s market adding to the inventory challenge. The first is the mortgage rate lock-in effect. Basically, some homeowners are reluctant to sell because of where mortgage rates are right now. They don’t want to move and take on a rate that’s higher than the one they have on their current home. The chart below helps illustrate just how many homeowners may find themselves in this situation:

Those homeowners need to remember their needs may matter just as much as the financial aspects of their move.

Misinformation in the Media Is Creating Unnecessary Fear

Another thing that’s limiting inventory right now is the fear that’s been created by the media. You’ve likely seen the negative headlines calling for a housing crash, or the ones saying home prices would fall by 20%. While neither of those things happened, the stories may have dinged your confidence enough for you to think it’s better to hold off and wait for things to calm down. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

That’s further limiting inventory because people who would make a move otherwise now feel hesitant to do so. But the market isn’t doom and gloom, even if the headlines are. An agent can help you separate fact from fiction.

How This Impacts You

If you’re wondering how today’s low inventory affects you, it depends on if you’re selling or buying a home, or both.

- For buyers: A limited number of homes for sale means you’ll want to seriously consider all of your options, including various areas and housing types. A skilled professional will help you explore all of what’s available and find the home that best fits your needs. They can even coach you through casting a broader net if you need to expand your search.

- For sellers: Today’s low inventory actually offers incredible benefits because your house will stand out. A real estate agent can walk you through why it’s especially worthwhile to sell with these conditions. And since many sellers are also buyers, that agent is also an essential resource to help you stay up to date on the latest homes available for sale in your area so you can find your next dream home.

Bottom Line

The low supply of homes for sale isn’t a new challenge. There are a number of long-term and short-term factors leading to the current inventory deficit. If you’re looking to make a move, let’s connect. That way you’ll have an expert on your side to explain how this impacts you and what’s happening with housing inventory in our area.

Explaining Today’s Mortgage Rates

If you’re following mortgage rates because you know they impact your borrowing costs, you may be wondering what the future holds for them. Unfortunately, there’s no easy way to answer that question because mortgage rates are notoriously hard to forecast.

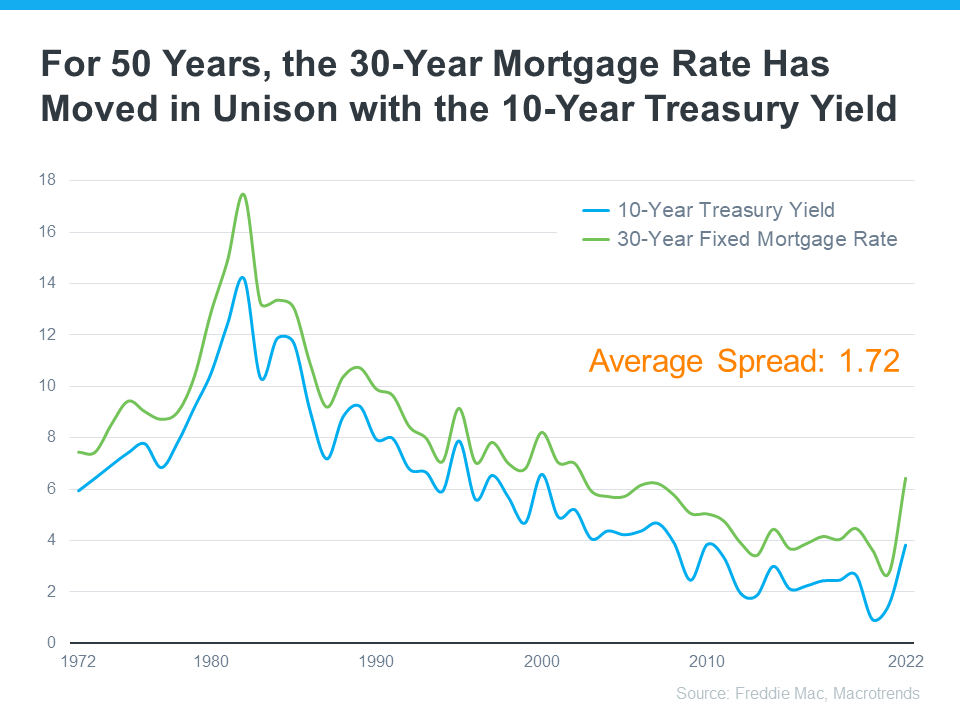

But, there’s one thing that’s historically a good indicator of what’ll happen with rates, and that’s the relationship between the 30-Year Mortgage Rate and the 10-Year Treasury Yield. Here’s a graph showing those two metrics since Freddie Mac started keeping mortgage rate records in 1972:

As the graph shows, historically, the average spread between the two over the last 50 years was 1.72 percentage points (also commonly referred to as 172 basis points). If you look at the trend line you can see when the Treasury Yield trends up, mortgage rates will usually respond. And, when the Yield drops, mortgage rates tend to follow. While they typically move in sync like this, the gap between the two has remained about 1.72 percentage points for quite some time. But, what’s crucial to notice is that spread is widening far beyond the norm lately (see graph below):

If you’re asking yourself: what’s pushing the spread beyond its typical average? It’s primarily because of uncertainty in the financial markets. Factors such as inflation, other economic drivers, and the policy and decisions from the Federal Reserve (The Fed) are all influencing mortgage rates and a widening spread.

Why Does This Matter for You?

This may feel overly technical and granular, but here’s why homebuyers like you should understand the spread. It means, based on the normal historical gap between the two, there’s room for mortgage rates to improve today.

And, experts think that’s what lies ahead as long as inflation continues to cool. As Odeta Kushi, Deputy Chief Economist at First American, explains:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal . . . However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

Similarly, an article from Forbes says:

“Though housing market watchers expect mortgage rates to remain elevated amid ongoing economic uncertainty and the Federal Reserve’s rate-hiking war on inflation, they believe rates peaked last fall and will decline—to some degree—later this year, barring any unforeseen surprises.”

Bottom Line

If you’re either a first-time home buyer or a current homeowner thinking of moving into a home that better fits your current needs, keep on top of what’s happening with mortgage rates and what experts think will happen in the coming months.

Don’t Expect a Flood of Foreclosures

The rising cost of just about everything from groceries to gas right now is leading to speculation that more people won’t be able to afford their mortgage payments. And that’s creating concern that a lot of foreclosures are on the horizon. While it’s true that foreclosure filings have gone up a bit compared to last year, experts say a flood of foreclosures isn’t coming.

Take it from Bill McBride of Calculated Risk. McBride is an expert on the housing market, and after closely following the data and market environment leading up to the crash, he was able to see the foreclosures coming in 2008. With the same careful eye and analysis, he has a different take on what’s ahead in the current market:

“There will not be a foreclosure crisis this time.”

Let’s look at why another flood is so unlikely.

There Aren’t Many Homeowners Who Are Seriously Behind on Their Mortgage Payments

One of the main reasons there were so many foreclosures during the last housing crash was because relaxed lending standards made it easy for people to take out mortgages, even if they couldn’t show that they’d be able to pay them back. At that time, lenders weren’t being very strict when assessing applicant credit scores, income levels, employment status, and debt-to-income ratio.

But now, lending standards have tightened, leading to more qualified buyers who can afford to make their mortgage payments. And data from Freddie Mac and Fannie Mae shows the number of homeowners who are seriously behind on their mortgage payments is declining (see graph below):

Molly Boese, Principal Economist at CoreLogic, explains just how few homeowners are struggling to make their mortgage payments:

“May’s overall mortgage delinquency rate matched the all-time low, and serious delinquencies followed suit. Furthermore, the rate of mortgages that were six months or more past due, a measure that ballooned in 2021, has receded to a level last observed in March 2020.”

Before there can be a significant rise in foreclosures, the number of people who can’t make their mortgage payments would need to rise. Since so many buyers are making their payments today, a wave of foreclosures isn’t likely.

Bottom Line

If you’re worried about a potential flood of foreclosures, know there’s nothing in the data today to suggest that’ll happen. In fact, qualified buyers are making their mortgage payments at a very high rate.

Equity Is a Game Changer for Homeowners Looking To Sell

If you’re a homeowner, you might be torn on whether or not to sell your house right now. Maybe that’s because you don’t want to take on a higher mortgage rate on your next home. If that’s your biggest hurdle, understanding your equity may be exactly what you need to help you feel more comfortable making your move.

What Equity Is and How It Works

Equity is the current value of your home minus what you owe on the loan. And recently, that equity has been growing far faster than you may expect.

Over the last few years, home prices rose dramatically, and that gave your equity a big boost very quickly. While the market has started to normalize, there’s still an imbalance between the number of homes available for sale and the number of buyers looking to make a purchase. And it’s because homes are in such high demand that prices are back on the rise today. Rob Barber, CEO of ATTOM, a property data provider, explains:

“Equity levels were high even during the recent downturn, and now they are going back up and better than ever.”

How Equity Benefits You in Today’s Market

With today’s affordability challenges, that equity can be a game changer when you move. Here’s why. Based on data from ATTOM and the Census, nearly two-thirds (68.7%) of homeowners have either paid off their mortgages or have at least 50% equity:

That means roughly 70% have a tremendous amount of equity right now.

Once you sell your house, you can use your equity to help with your next purchase. It could be some (if not all) of what you’ll need for your next down payment. It may even be enough to allow you to put a considerably larger down payment on your next home, so you don’t have to finance quite as much. And, if you’ve been in your current house for years, you may have even built up enough equity to pay in all cash. If that’s true for you, you’d be able to avoid borrowing altogether, so you wouldn’t have to worry about today’s mortgage rates.

How To Find Out How Much Equity You Have

The best way to learn how much you have is to reach out to a trusted real estate agent for a Professional Equity Assessment Report (PEAR).

Bottom Line

If you’re planning to make a move, the equity you’ve gained can make a big impact. To find out just how much equity you have in your current home and how you can use it to fuel your next purchase, let’s connect.

Momentum Is Building for New Home Construction

If you’re in the process of looking for a home today, you know the supply of homes for sale is low because you’re feeling the impact of having a limited pool of options. And, if your biggest hurdle right now is that you’re having trouble finding something you like, don’t forget that a newly built home is a great option.

As a recent article from the National Association of Realtors (NAR) says:

“Home buyers continue to be met with limited housing options during what’s typically the real estate market’s busiest season. . . . The current supply of existing homes is about half the level it was in 2019 . . . Meanwhile, the market for new construction is a bright spot.”

Here’s a look at a key metric that shows just how much new home construction is ramping up nationwide. It’s called new residential completions. Basically, completions are newly built homes that are finished and ready to move into.

The graph below uses data from the Census to show the trend of new-home completions over time, including the long-term average for the number of finished housing units.

As you can see on the left (shown in orange), leading up to the housing crash, builders exceeded that average. The result was an oversupply of homes on the market, so home values declined. That was one of the factors that led to the housing crash back in 2008.

Since then, the level of new home construction has fallen off, and builders haven’t built enough homes to meet the historical average (shown in red). That underbuilding left the housing market with a multi-year inventory deficit. And, that deficit is part of what makes inventory so low right now.

But, here’s the good news. The green on the right shows that according to the latest report from the Census, builders are matching the long-term average right now. And that means they’re bringing more newly built homes to the market than they have in recent memory.

And residential starts and permits are also gaining momentum. Starts are homes where the construction has officially kicked off. Permits are homes where builders are planning to break ground soon. Since both are up, it’s a sign there are even more newly built homes coming soon.

What This Means for You

More newly built homes in various stages of the construction process means your pool of options just got bigger. If you’re looking to move right now and timing is important to you, reach out to a local Coldwell Banker Realty real estate professional to explore the homes that were recently completed in your area. If construction is done on those homes, you should be able to move in quickly.

But, if you can wait a bit and the idea of customizing a home from the ground up appeals to you, ask that same agent about the homes in your area that are in the process of being built. If you buy a home that’s still in the works, you can help pick the features and finishings along the way. And when none of the homes you’ve looked at so far are to your liking, being able to tailor one to your taste may be your best option.

Either way, a trusted Coldwell Banker Realty real estate agent is a crucial part of the process. They’ll know exactly what’s available in your area and can base their recommendations on your unique needs, desired neighborhoods, and more.

Bottom Line

So, if you’re having trouble finding a home you like while inventory is so low, it may be time to consider looking into new-home construction. If you’d like to start that conversation, let’s connect so you’re working with an expert on what’s available in our area.

Pricing Your House Right Still Matters Today

While this isn’t the frenzied market we saw during the ‘unicorn’ years, homes that are priced right are still selling quickly and seeing multiple offers right now. That’s because the number of homes for sale is still so low. Data from the National Association of Realtors (NAR) shows 76% of homes sold within a month and the average saw 3.5 offers in June.

To set yourself up to see advantages like these, you need to rely on an agent. Only an agent has the expertise needed to find the right asking price for your house. Here’s what’s at stake if that price isn’t accurate for today’s market value.

The price you set for your house sends a message to potential buyers.

Price it too low and you might raise questions about your home’s condition or lead buyers to assume something is wrong with it. Not to mention, if you undervalue your house, you could leave money on the table, which decreases your future buying power.

On the other hand, price it too high and you run the risk of deterring buyers from ever touring it in the first place. When that happens, you may have to do a price drop to try to re-ignite interest in your house when it sits on the market for a while. But be aware that a price drop can be seen as a red flag for some buyers who will wonder why the price was reduced and what that means about the home.

A recent article from NerdWallet sums it up like this:

“Your house’s market debut is your first chance to attract a buyer and it’s important to get the pricing right. If your home is overpriced, you run the risk of buyers not seeing the listing . . . But price your house too low and you could end up leaving some serious money on the table. A bargain-basement price could also turn some buyers away, as they may wonder if there are any underlying problems with the house.”

Think of pricing your home as a target. Your goal is to aim directly for the center – not too high, not too low, but right at market value.

Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it. That makes it more likely you’ll see multiple offers too. Plus, when homes are priced right, they still tend to sell quickly.

To get a high-level look into the potential downsides of over or underpricing your house and the perks that come with pricing it at market value, see the chart below:

Lean on a Coldwell Banker Realty Professional’s Expertise to Price Your House Right

So why is a Coldwell Banker Realty agent essential in finding the right price? Your local agent has the skill and the insight necessary to find the market value of your home. They’ll use their expertise to determine a realistic listing price by assessing:

- The prices of recently sold homes

- The current market conditions

- The size and condition of your house

- The location of your house

Bottom Line

Pricing your house at market value is critical, so don’t rely on guesswork. Let’s connect to make sure your house is priced right for today’s market.

How Inflation Affects Mortgage Rates

When you read about the housing market in the news, you might see something about a recent decision made by the Federal Reserve (the Fed). But how does this decision affect you and your plans to buy a home? Here’s what you need to know.

The Fed is trying hard to reduce inflation. And even though there’s been 12 straight months where inflation has cooled, the most recent data shows it’s still higher than the Fed’s target of 2%:

While you may have been hoping the Fed would stop their hikes since they’re making progress on their goal of bringing down inflation, they don’t want to stop too soon, and risk inflation climbing back up as a result. Because of this, the Fed decided to increase the Federal Funds Rate again last week. As Jerome Powell, Chairman of the Fed, says:

“We remain committed to bringing inflation back to our 2 percent goal and to keeping longer-term inflation expectations well anchored.”

Greg McBride, Senior VP, and Chief Financial Analyst at Bankrate, explains how high inflation and a strong economy play into the Fed’s recent decision:

“Inflation remains stubbornly high. The economy has been remarkably resilient, the labor market is still robust, but that may be contributing to the stubbornly high inflation. So, Fed has to pump the brakes a bit more.”

Even though a Federal Fund Rate hike by the Fed doesn’t directly dictate what happens with mortgage rates, it does have an impact. As a recent article from Fortune says:

“The federal funds rate is an interest rate that banks charge other banks when they lend one another money . . . When inflation is running high, the Fed will increase rates to increase the cost of borrowing and slow down the economy. When it’s too low, they’ll lower rates to stimulate the economy and get things moving again.”

How All of This Affects You

In the simplest sense, when inflation is high, mortgage rates are also high. But, if the Fed succeeds in bringing down inflation, it could ultimately lead to lower mortgage rates, making it more affordable for you to buy a home.

This graph helps illustrate that point by showing that when inflation decreases, mortgage rates typically go down, too.

As the data above shows, inflation (shown in the blue trend line) is slowly coming down and, based on historical trends, mortgage rates (shown in the green trend line) are likely to follow. McBride says this about the future of mortgage rates:

“With the backdrop of easing inflation pressures, we should see more consistent declines in mortgage rates as the year progresses, particularly if the economy and labor market slow noticeably.”

Bottom Line

What happens to mortgage rates depends on inflation. If inflation cools down, mortgage rates should go down too. Let’s talk so you can get expert advice on housing market changes and what they mean for you.

Bathroom Storage Ideas

The cabinet under a bathroom sink is notorious for becoming a mess of miscellaneous items. But you can transform this area into a functional space by implementing some smart storage solutions.

Coordinate

If you have open shelving beneath your sink, use coordinating containers or baskets to hold necessities. Pick neutral colors or fun patterns that complement the room’s color scheme.

Maximize

Increase vertical storage space under your sink by installing multi-tiered drawers. Place items like toilet paper and towels in bigger drawers and bottles of shampoo or cleaning supplies in smaller sections.

Organize

Use drawer organizers for the items you reach for daily. Adding putty to the bottom corners will keep the organizer from moving as you open and close the drawers.

Natural Elements in Interior Designs

Interior designers understand that people feel grounded and calm when surrounded by organic elements. Natural materials can add a touch of organic beauty and create a serene, refreshing atmosphere in your home.

To bring a bit of outdoor magic into your living space, choose furnishings, surfaces and colors that echo nature’s beauty. Natural materials lend a sense of comfort and familiarity whether you prefer modern, rustic or minimalist style.

Stone and brick are timeless, and interior designers keep these fresh by combining them with new colors, textures and shapes. Consider a stone or brick hearth if you prefer a classic look that projects warmth and coziness.

Live plants are the ultimate natural decor choice. They lend color and vibrancy with the added benefit of cleaning the air you breathe. Try creating a living wall with moss or other plants for a serious oxygen boost and a literal twist to the idea of a “living” room.

Warm up your space even more with wood flooring, furniture and accents. Find pieces and textures that coordinate with your decor — they can be as traditional or as modern as you like. Exposed beams, stained window frames and wall paneling can transform an ordinary room into a one-of-a-kind retreat. Personalize with wood accent pieces like artistic carvings or bowls.

If you want to add character along with a nod to sustainability, try repurposing old wood or choose materials like bamboo and rattan. Versatile and stylish, these natural materials make great design choices for unique furnishings, durable flooring, elegant storage baskets, and chic decor.

Homebuyers Are Getting Used to the New Normal

Before you decide to sell your house, it’s important to know what you can expect in the current housing market. One positive trend right now is homebuyers are adapting to today’s mortgage rates and getting used to them as the new normal.

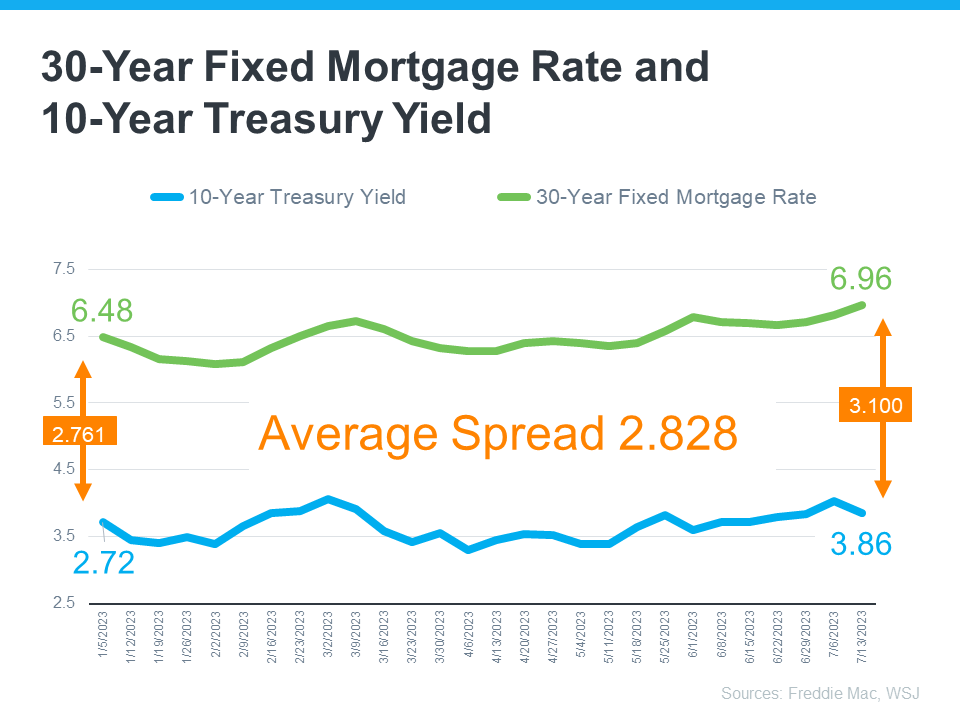

To better understand what’s been happening with mortgage rates lately, the graph below shows the trend for the 30-year fixed mortgage rate from Freddie Mac since last October. As you can see, rates have been between 6% and 7% pretty consistently for the past nine months:

According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), mortgage rates play a significant role in buyer demand and, by extension, home sales. Yun highlights the positive impact of stable rates:

“Mortgage rates heavily influence the direction of home sales. Relatively steady rates have led to several consecutive months of consistent home sales.”

As a seller, hearing that home sales are consistent right now is good news. It means buyers are out there and actively purchasing homes. Here’s a bit more context on how mortgage rates have impacted demand recently.

When mortgage rates surged dramatically last year, escalating from roughly 3% to 7%, many potential buyers felt a bit of sticker shock and decided to hold off on their plans to purchase a home. However, as time has passed, that initial shock has worn off. Buyers have grown more accustomed to current mortgage rates and have accepted that the record-low rates of the last few years are behind us. As Doug Duncan, SVP and Chief Economist at Fannie Mae, says:

“. . . consumers are adapting to the idea that higher mortgage rates will likely stick around for the foreseeable future.”

In fact, a recent survey by Freddie Mac reveals 18% of respondents say they’re likely to buy a home in the next six months. That means nearly one out of every five people surveyed plan to buy in the near future. And that goes to show buyers are planning to be active in the months ahead.

Of course, mortgage rates aren’t the sole factor affecting buyer demand. No matter where mortgage rates stand, people will always have reasons to move, whether it’s for job relocation, changing households, or any other personal motivation. As a seller, you can feel confident there is a market for your house today. And that demand is pretty strong as buyers settle into where rates are right now.

Bottom Line

The way buyers perceive today’s mortgage rates is shifting – they’re getting used to the new normal. Steady rates are contributing to strong buyer demand and consistent home sales. Let’s connect so we can get your house on the market and in front of those buyers.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link